Journey rewards cards. These credit cards supply factors redeemable for travel—which includes flights, hotels, and rental cars—with Just about every dollar you spend.

you already know some of my favorite budgeting tips and tricks, it’s time for you to get right after it. And try to remember: When you know the purpose of budgeting isn’t to Restrict your freedom but to give you liberty, you’ll be within the street to loving your existence and your bank account! That’s what we call profitable with money. Spending plan A lot quicker (and Simpler)

Beyond your credit rating, you’ll also should decide which perks very best fit your Life-style and shelling out behavior.

Investment strategies are types of investing that help people meet up with their quick- and prolonged-phrase goals. Strategies count on a range of aspects, which include:

Thankfully, the savings earth has become a little more automatic. You can now save your spare adjust utilizing applications like Acorns.

Buyers can use their strategies to formulate their own individual portfolios or do so via a financial Experienced. Strategies are not static, which implies they need to be reviewed periodically as conditions alter.

When analyzing presents, make sure you review the financial institution’s Stipulations. Pre-capable presents usually are not binding. If you find discrepancies with your credit rating or information from your credit report, remember to Get in touch with TransUnion® immediately.

This could reduce the temptation to dip into it for nonemergencies. Saving for your residence, holiday vacation or new car or truck? Stash Individuals resources in separate accounts to help you see progress toward Just about every intention.

Established everyday living goals—big and little, financial and Life-style—and produce a blueprint for attaining These goals.

Not spending any money in daily or week will let you rapidly save money. This can drive you to think about each and every dollar you shell out. After a no-devote working day (or days), You may additionally recognize your paying out practices have improved.

necessities are cared for, you are able to fill in the remainder of the types in your spending budget. 5. Pay back your credit card debt.

Make confident you’re not just focusing on the big financial goals like putting a deposit on a house or purchasing a marriage. Established scaled-down types too.

We retain a firewall involving our advertisers and our editorial crew. Our editorial staff isn't going to get immediate payment from our advertisers. Editorial Independence

There are many types of mutual money, symbolizing the types of securities in which they spend, their investment targets, and check here the kind of returns which they find. Most employer-sponsored retirement plans put money into mutual resources.

Jonathan Taylor Thomas Then & Now!

Jonathan Taylor Thomas Then & Now! Joshua Jackson Then & Now!

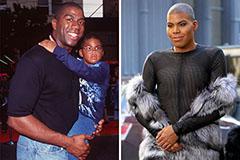

Joshua Jackson Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now! Batista Then & Now!

Batista Then & Now!